Economic Note: Estimating the Impact of the COVID-19 Pandemic on Consumer Behaviour in Malta – Autumn 2020 Update

Compiled by The Office of Dr Joseph Muscat and Sagalytics¹

1. Executive Summary

This Economic Note summarises the main findings of a telephone-based, scientific survey conducted by Dr Vincent Marmara and Sagalytics during September 2020, and is supplemented by an economic analysis carried out by The Office of Dr Joseph Muscat. It updates the assessment carried out in May 2020.

The findings show that during the summer period, economic activity in Malta has been considerably stronger than what was envisaged by households back in May, with our estimate of the drop in Gross Domestic Product (GDP) revised to -8%, from our larger original estimate of -11.3%. Upward revisions were mainly registered in accommodation and food service activities as well as in the retail sector. The largest revisions in consumption profiles were made by respondents aged 16-25 years, while the actual consumption decisions of respondents aged 66+ years have been fairly in line with the projections provided in May.

The better-than-expected consumption outcomes might indicate that households have reassessed the risks associated with the pandemic and are starting to come to terms with the new normality characterised by an ongoing COVID-19 transmission within the community. Furthermore, the increase in consumption typically took place in sectors where government intervened directly through consumption vouchers. Despite these upward revisions, consumption of all services considered in the survey are still significantly lower than pre-pandemic baseline levels.

Going forward, some sectors are expected to continue experiencing a slight rebound in consumption during the autumn and winter period when compared to summer. The largest increases are expected to be registered in the retail sector, coffee shops and restaurants. On the other hand, respondents have indicated that they intend to cut back on their consumption of accommodation services in the form of hotel and farmhouse breaks, which is also typical post-summer consumer behaviour.

In line with the results derived from the May survey, even after the vaccine is made available to the general public, household consumption is expected to remain lower than that prior to the pandemic. Moreover, the latest results indicate that households are foreseeing stronger cuts to their long-run consumption when compared to the May results, as they reassess their long-run financial position after the COVID-19 pandemic has abated.

These survey responses are consistent with a fall in aggregate consumption of around 25% during summer, followed by a projected fall of 24% in autumn and winter. Based solely on these figures for consumption, aggregate economic activity in the second half of the year is expected to be around 8% lower than the pre-pandemic level, or a quarter better than our May prediction.

On the other hand, after the availability of a vaccine, aggregate consumption is expected to be 8.5% lower than pre-pandemic levels, an increased decline when compared to the 6% drop envisaged in May. Better-than-expected short term consumption patterns coupled with deteriorating medium- and long-term expectations seem to indicate that while consumers are adapting to the immediate economic impact of COVID-19 in a less taxing manner than expected, they consider the wider effects to now be of a more structural nature and harder to overcome. Deviations in long run GDP as a result have been revised downwards to -2.8%, down from the -2% projected in May.

The findings highlight the importance of devising correct economic incentives which on the one hand help increase household spending while at the same time bolster consumer confidence. In line with the conclusions drawn up in our earlier report, respondents have indicated that the government assistance in the form of wage subsidies and consumption vouchers have been quite successful in boosting demand. The survey also indicates that respondents would tend to utilise future incentives in the form of consumption vouchers more in the coming months.

Incentivising the active participation of workers in the labour supply is a priority especially when considering that prolonged periods of inactivity would make it more difficult for workers, especially women, to reengage with the productive side of the economy. In line with the results published in May, respondents have been very reluctant to send their children to childcare centres over the summer period. The prospects however improve significantly over the autumn and winter months with around 43% of respondents intending to make use of childcare centres. On the basis of these results, the risks of negative supply shocks to the labour supply in Malta seem, at the time, to be relatively low.

We have also chosen to test the sentiment in regards to the reopening of schools. The majority of respondents (66.4%) have indicated that they are in favour of schools reopening this October even if infection cases persist across Malta. When a child or member of the staff is found positive to COVID-19, the majority of respondents (57%) believe that the most suitable action to be taken is to close the class where the positive case is found and test the students and relative staff. Only 8% of respondents believe that the scholastic year should be postponed and all schools closed in the case of a positive case within a school.

The study has three main economic policy implications, besides suggesting the importance of keeping childcare and schools open and of continuing to enforce health measures to make consumers feel safe.

The first is that government consumption vouchers need to remain an important part of the policy tool set, at least until a vaccine is found, and that they need to remain very targeted rather than spread towards sectors that are already doing better than others.

The second is that the COVID-19 wage supplement is sustaining the income of lower income households with a higher marginal propensity to consume, and in this sense, it has a strong multiplier effect which needs to be maintained in the current climate.

The third is that for growth to return to pre-pandemic levels, the predicted long-term drop in consumption needs to be offset by a rise in another component of aggregate demand, with the most obvious candidate being investment financed by the large pool of savings that have been accumulated.

2. Methodology

The methodology is consistent with the survey undertaken in May of this year. The sample is made up of 600 respondents which were randomly selected out of Malta’s population aged 16 and over, stratified across the age, gender and regional district dimensions. It can be considered to be representative of the general population, with a margin of error of +/- 4%.

The survey seeks to capture changes in the consumer behaviour of Malta’s population across a spectrum of goods and services demanded following the onset of the COVID-19 pandemic. It also tries to elicit information on the effectiveness or otherwise of measures that have been undertaken by the public sector in order to attenuate the economic impact of the COVID-19, and whether further measures might be needed in the near future. Finally, the survey asks for the opinion of respondents vis-à-vis the re-opening of schools and childcare centres.

The questionnaire was jointly designed by Sagalytics and The Office of Dr Joseph Muscat.

The survey questions are designed in line with those featuring in a previous survey undertaken in May 2020. We therefore asked respondents four questions:

“How many times did you go to or used the following services during summer 2020?”

“How many times are you planning to go or use the following services during autumn/winter 2020?”

“When the vaccine is available, how many times are you going to visit or use the following places/services?”

These questions are asked with regards to the following services:

- Restaurants

- Coffee shops

- Clothes and footwear shops

- Other retail (furniture, home appliances) – Break in a local hotel

- Break in a farmhouse in Malta / Gozo

- Holiday abroad

- Public transport

- Ride hailing services – Taxis

First and foremost, the design of the survey allows us to compare the projections of household consumption by sector as reported by respondents in the first survey, with actual realised consumption behaviour as reported in the latest survey. This comparison is important in understanding whether households have started to reassess their projected consumption profile when compared to that planned back in May. The third and fourth questions provide new projections for household consumption of selected services for the next six months and for the longer run, after the availability of a COVID-19 vaccine. The final question is also important in understanding whether consumers have changed their view of the longer run repercussions associated with the public emergency.

3. Change in Consumer Behaviour due to COVID-19: Forecasts vs Actual Results

Results in Chart 1.1 indicate that in almost all categories, the actual consumption frequency during summer 2020, as reported by respondents in the current survey, has fallen by less than what had been forecasted in the May.² Significant positive variances when compared to forecasts have been registered in restaurants, coffee shops, clothing and footwear, other retail and hotel and farmhouse breaks. Actual outcomes for consumption of holidays abroad, public transport, ride hailing and taxis are either not significantly different or else worse than what was forecasted by respondents in May.

Despite the strong upward revisions when compared to projected consumption back in May, results still indicate very strong falls in the consumption of each category when compared to the pre-pandemic levels. These range from -42.5% for the case of restaurants to an almost complete halt in the use of taxis and in holidays abroad.

With a revision of almost 40 percentage points, the largest discrepancy between actual and forecasted consumption was registered in the restaurant category. Interesting implications emerge when looking at a breakdown of results by gender and age cohort (see Chart 1.2).³

First, revisions in weekly restaurant visits are equally distributed gender wise. This is not the case when one looks at results broken down by demography. Indeed, the strongest revisions to restaurant visits were registered in the 16-25 age cohort (+57.7pp), followed by the 26-35 age cohort (+47.7pp). The lowest revisions were registered in the 46-55 age cohort with an increase of 30pp, followed by the 66+ age cohort. The profile of these revisions can be generally found across all consumption activities included in the survey.

Results in Chart 1.3 indicate that when averaging across all consumption activities, the youngest cohorts have made the largest revisions in their consumption profile when compared to the projections provided in the May survey. 4 These results contrast sharply with those reported in our latest note. A striking result that emerged from the May survey, was that despite the scientifically proven lower level of susceptibility of the younger cohorts to COVID- 19 complications, respondents, aged 16-25 years and 26-35 years, were expected to cut consumption activities across all sectors by around 80%, in line with the cuts foreseen by the oldest cohorts.

Chart 1.1: Summer forecasts vs actuals

During summer 2020 however, respondents aged 16-25 years have experienced the lowest fall in their average consumption of the services included in the survey, when compared to their pre-pandemic baseline levels. On the other hand, the actual average consumption of respondents within the 66+ age cohort has been fairly in line with the forecasts indicated in the May survey.

Chart 1.2: Summer forecasts vs actuals – Restaurants

The significant divergence in household consumption outcomes during summer vis-à-vis households’ projections done in May, are due to a number of factors. It is important to note that the forecasts for consumption presented back in May, are dependent on the information set available to the respondents of the survey at that specific point in time.

To this end, forecasts produced by households in May need to be analysed within the context of an ongoing (even if not fully-fledged) national lockdown. Given the novelty of the situation they were facing at the time, households were planning to adopt a particularly conservative approach when deciding whether to consume the particular services considered in the surveys.

The general upward revision in consumption levels during summer is attributable to two factors. First, the population has started to become more accustomed with “the new normal”. Both during and briefly after the lockdown period, actual and projected consumption trends were characterised by a heightened anxiety. The new data show that as the summer months unfolded, some of the concerns started to abate slowly, as consumers were eager to accustom themselves to a new type of normality. This general sense of optimism during the summer months could have also been driven by a considerable reduction in daily new COVID- 19 infections.

Consumer confidence is also being bolstered by the safety precautions adopted by retail, food services and accommodation establishments. Indeed, around 80% of respondents declare to feel safe when either shopping or while eating in a restaurant.

Chart 1.3: Summer forecasts vs actuals – Average

Secondly, consumption behaviour in summer could have been boosted by the Economic Regeneration Plan launched by the Maltese government in June. One might note that the strongest positive revisions in consumption patterns were registered in sectors which directly benefitted from financial aid provided by the government in the form of consumption vouchers.

Indeed, the consumption activities with the strongest performance relative to what was projected in May, fall under the accommodation and food services activities as well as the retail sector, the two sectors directly targeted by the government voucher initiative.

Chart 2: Projections for household consumption

4. A Slight Rebound in Consumption, but not in all Sectors

Despite considerable drops in consumption when compared to the pre-pandemic levels, some sectors are expected to experience a slight rebound in consumption during the autumn period when compared to summer as shown in Chart 2.⁵ The largest increases are expected to be registered in the retail sector, in coffee shops and restaurants. More marginal pick-ups are also expected in the use of public transport, ride hailing services and in holidays abroad.

On the other hand, when compared to the summer period, respondents have indicated that during autumn, they are most likely to further cut back consumption hotel breaks in Malta and Gozo and farmhouse breaks.

Despite a marginal rebound in the majority of activities, the level of consumption in all of the sectors considered in this survey is still expected to be around 65% lower when compared to the pre-pandemic levels, up from the drop of 68% registered over summer.

Respondents have also indicated that once a vaccine becomes available to the general public, they intend to significantly boost the consumption of all activities. This indicates that the majority of households still considers the eventual availability of a vaccine as necessary to return to their normal way of life. Nevertheless, despite the significant pick-up in economic activity that is seen after the discovery of a vaccine, respondents have indicated that on average they still expect to consume less than they did before the COVID-19 pandemic started.

The largest permanent drops are expected to persist in other retail, holidays abroad, hotel breaks in both Malta and Gozo, public transport and taxis. If the latter materialists, gains in efficiency made through unprecedented investments in road infrastructure to alleviate traffic congestion will reap a lower benefit than expected, given a probable shift towards less collective means of transport. It this trend persists globally, further investments in infrastructure would be necessary prior to what was anticipated in the medium term.

The fact that the permanent drop of consumer activity extends to all activities and services considered in this survey might also indicate that the current medical and economic uncertainty is negatively affecting consumers’ perception of their future financial position. In other words, even households who are not currently experiencing financial difficulties are cutting back on expenditure because of fear of the unknown. In the light of this drop in consumer confidence, these responses might be indicative of an increase in precautionary savings during the pandemic, and even after a vaccine is made available. Preliminary banking data seems to confirm this trend.

Moreover, these results compare unfavourably with the long run predictions extracted from the May survey. Respondents are now projecting more significant long term cuts in the consumption of almost all sectors under consideration. This indicates that despite the general improvement in consumer confidence in the short run, long run prospects have not improved, but have rather worsened somewhat. This drop in long-run consumption trends might be driven by a worsening of consumers’ outlook on their long-run financial positions when compared to four months ago.

In order to understand what these survey results imply on Gross Domestic Product aggregates, we have undertaken a grossing up exercise, similar to the one undertaken in May. The services and activities included in the survey have been mapped to the final consumption expenditure of households disaggregated by Classification of Individual Consumption by Purpose (COICOP at 3-digit level as at 2019). We have then used the weights corresponding to each COICOP sub-category to gross-up the figures that have emerged from this survey.

This mapping exercise, indicates that the services and activities considered in this survey cover around 43%, that is a considerable proportion, of all activities that fall under household consumption. Moreover, the proportion of aggregate household consumption that is not captured by this survey includes consumption activities that are less discretionary in nature than those included. These include consumption on food and beverages, water and electricity consumption, health, education and communication.

In order to come up with a conservative estimate of the change in aggregate consumption, we assume that these consumption sub-categories remain constant at their baseline level, that is, that they are not affected by the pandemic.

Table 1: Expected effects on aggregate consumption and GDP

Taking in consideration the services considered in these surveys, results in Table 1 indicate that aggregate consumption in summer has fallen by around 25.2%. Under the assumption that there are no changes to the other aggregate demand components, and taking in consideration the import intensity of household consumption, these figures translate to a contribution to aggregate GDP of around -8.4%. Mirroring the disaggregated results discussed in section 3 above, these figures are considerably less negative than those based on the projections given by respondents in May. The drop in GDP is a quarter less than predicted and about half of that reported by the National Statistics Office for the second quarter of the year.

Going forward, aggregate consumption is expected to rebound slightly in autumn, albeit still being considerably lower than the pre-pandemic baseline level by some 24%. This is expected to drive down GDP when compared to the pre-pandemic levels by around 8%. A worsening in the general financial conditions of households is expected to drive down consumption and GDP even after the availability of a vaccine.

In line with previous observations, consumers’ long-run prospects have worsened somehow over the summer, with the drop in long-run aggregate consumption increasing from -6.0% to – 8.5%. This is also expected to negatively weigh on GDP, which is now expected to remain below its pre-pandemic level by around 3%, up from a drop of 2% projected in May.

5. The Case for Government Intervention

The above results can also be broken-down by whether respondents are either currently in employment and receiving their full wage or whether they are employed and receiving the COVID-19 wage supplement. Respondents who are currently receiving aid while working have on average cut back on their consumption by the same extent when compared to counterparts who are employed but not receiving subsidies. This result might be indicative that the COVID-19 wage subsidy might have successfully supplemented the fall in their disposable income of the employees most hardly hit by the economic repercussions of the emergency.

Nevertheless, it is important to note that while the wage subsidy is effective at alleviating the negative income effects at the current juncture, it is both inadequate and unsustainable to support the normal level of household consumption for extensive periods. This belief is reinforced by the fact that all types of respondents are expected to cut their consumption pattern significantly even after the vaccine for COVID-19 is made available, suggesting that consumers are concerned about a possible loss in their permanent income.

Results also indicate that respondents that are currently receiving aid had a larger average frequency of use of all service categories when compared to counterparts who are currently in employment but not receiving any aid. This indicates that former might have a larger average propensity to consume, showing a particularly high marginal effectiveness of government intervention aimed at helping individuals who are currently receiving aid in the form of wage subsidies. This are probably lower income earners.

In an attempt to gauge the effectiveness of the government consumption vouchers, respondents were asked whether the current programme has affected either negatively or positively their consumption pattern.⁶ 29.7% of respondents have indicated that the vouchers have increased their overall consumption. This figure is in line with the projections put forward in the May survey whereby 30% of respondents indicated that in the event of financial aid they would increase consumption.

Looking at a demographic disaggregation of results, the voucher scheme seems to have been mostly effective in propping up consumption of males and of respondents in the 46-55 years and 16-25 years cohorts. As already remarked, respondents in these two cohorts are amongst those with the highest revisions in their consumption profiles in summer when compared to the forecasts provided in May. This is further indication that the voucher scheme introduced by the government has been quite effective in boosting consumption during the summer months.

Government consumption vouchers might be an even more effective policy tool going forward. In fact, a significant 43% of respondents are now declaring that they would increase their consumption if new vouchers are made available. Respondents in the youngest age cohort and those residing in the southern harbour districts, are expected to be the most receptive of government aid in the form of vouchers, with almost 56% and 53% respectively declaring that such aid would help them increase consumption. On the other hand, respondents aged 66+ years and those residing in the western part of the island are expected to boost their consumption the least in the event of a new vouchers.

6. Childcare Uptake Reduces Risks of Labour Market Dropouts

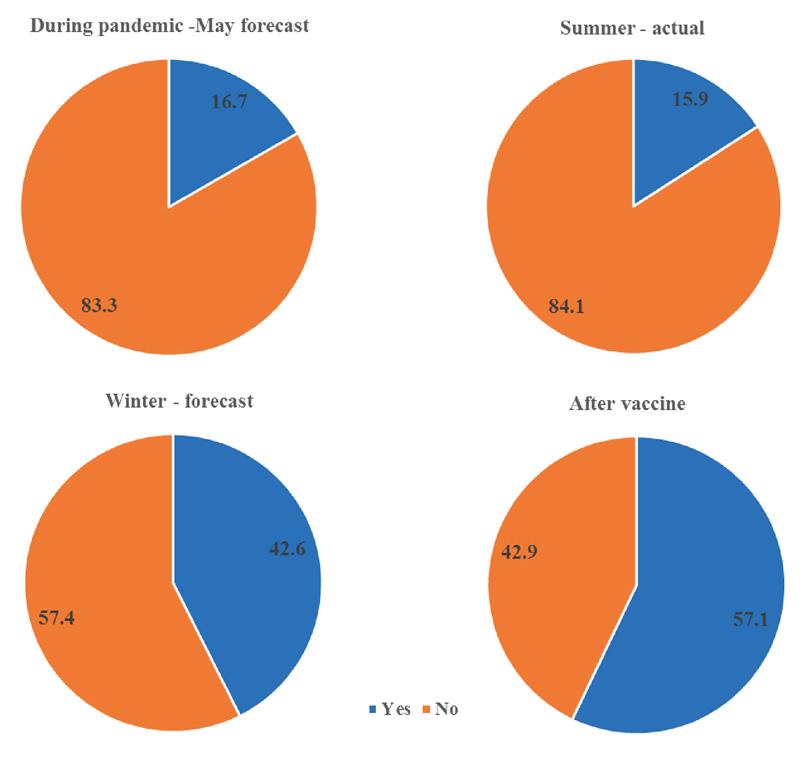

The information collected about the use of childcare centres is especially important with regards to potential supply-side implications that the COVID-19 pandemic might have on the Maltese labour market, and are duly illustrated in Chart 1.⁷

Around one in ten of respondents in both surveys have indicated that they have a child who is less than 5 years old. Out of these, around half stated that they used to send their children to childcare centres before the pandemic started. When asked whether they have sent their children to childcare centres during summer, 16% answered positively. This figure is in line with percentage of respondents that, back in the May survey, showed an intention to send their children to childcare centres in case of low daily cases of COVID-19.

Chart 1: Percentage of Respondents with a Child less than 5 Years of Age who make use of Childcare Facilities

However, when respondents were asked whether they will send their children to childcare centres during this autumn and winter, almost 43% have responded positively. The figure increases further to 57% once a vaccine is found and made available.

The increase in the proportion of respondents sending their children to childcare centres over the autumn and winter is very encouraging from a macroeconomic point of view. A reduction in the willingness to make use of childcare centres is generally seen to have major economic and social repercussions as it implies that there is a concrete risk of workers deciding to drop out of the labour force for the duration of the pandemic. This effect also risks to prolong itself even after the pandemic eases, as it becomes increasingly difficult for workers that have been out of the labour force for a long period of time to re-engage with the productive side of the economy, again with women being those most at risk also to fall back in the poverty trap.

These results however, especially those regarding the coming months, indicate that the risks of experiencing negative supply-side shocks through a temporary or permanent reduction in labour market participation rates, are at least for the time being, relatively low.

7. Opening Schools and Keeping Them Open

Around 66.4% of respondents have indicate that they are in favour of opening schools even if the cases are expected to increase. These figures are generally robust to different demographic indicators such as gender and age cohorts, with a slightly wider variance when considering the respondents’ geographical area of residence. Almost 80% of the respondents residing in south eastern districts expressed a positive opinion on the opening of schools. The lowest proportions in this regard were registered in the southern harbour district with nearly 60% in favour of schools opening even with persistent COVID-19 cases.

When asked about the actions that need to be taken in case a child or member of the staff is found positive to COVID-19, the majority of respondents (57%) indicated that the most suitable action to be taken is to close the class where the positive case is found and to perform a swab test of the teacher and children in the class. 34.8% of respondents prefer to close the entire school and to extend swab tests to all students and staff in the affected school. 8.2% of respondents, on the other hand, would prefer to close all schools if a positive case is found and wait till the pandemic is over before reopening.

These results are again similar when disaggregated across the gender and age cohort dimensions. Results are however more heterogenous when viewed across the geographic dimension. Respondents from western and southern harbour districts, are more inclined to choose one of the two more extreme actions in case of a positive case in a school.

8. Policy Considerations

There are two trends in consumer sentiment that command attention. On one hand, nearly all categories have consumed far more than they had predicted they would. On the other hand, the expectation of a fast and complete return to normality is dampening. These seemingly contradictory, but totally reconcilable, trends have very important policy implications.

The most obvious is that government assistance together with confidence-boosting initiatives are necessary and can make a great difference to behaviour. The survey results show that government vouchers are incredibly effective in raising consumption, leading for instance to an overall halving of the projected drop in the consumption of restaurant services. Furthermore, the effectiveness of this policy tool in the coming months will be further enhanced. A larger proportion of the population have indicated that they would spend more if more vouchers are given. Thus, a new government consumption voucher is necessary to sustain the economy in the coming months.

Besides vouchers, policymakers need to consider carefully and possibly reinforce the COVID-19 wage supplement. Its recipients appear to have a very high marginal propensity to consume, consistent with the fact that they tend to have lower-than-average incomes. Government assistance here does not just have a social element, but quite importantly has a stronger economic multiplier effect. Sustaining this form of intervention makes sense both socially and economically.

Results suggest that government’s choice to lower assistance to certain sectors was appropriate as their demand improved greatly due to other measures it introduced. Any further changes to the COVID-19 wage supplement need to be complemented by other forms of assistance.

Finally, it is crucial that policymakers look beyond sustaining aggregate demand in the immediate term. The survey results indicate more long-term impacts of the pandemic where we might be looking at a more permanent reduction in consumption propensities. This implies that to maintain pre-pandemic economic growth, Malta will need new sources of growth.

One possible solution could be to create opportunities for the resulting higher level of savings to move from no-interest bank deposits to higher-yielding financial instruments directed towards new productive investment. Government would have to take a lead on this, further using the Malta Development Bank, amongst others. Nevertheless, while the MDB needs to take a more bullish approach to supplement its already good entry in the market, commercial banks need to start participating more actively, or be nudged to do so using mainstream policy measures.

At the same time, government-led infrastructural projects, which until recently were seen as a way to support private sector-led growth, will now become central in growing the economy. This would help bring back potential output to its pre-pandemic trend. The expansion in industrial infrastructure specified in government’s Economic Regeneration Plan is one initiative that can bolster growth, but it has to be accompanied by other significant investments.