Economic Note: Estimating the Impact of the COVID-19 Pandemic on Consumer Behaviour in Malta

Compiled by The Office of Dr Joseph Muscat and Sagalytics¹

1. Executive Summary

This Economic Note summarises the main findings of a telephone-based, scientific survey conducted by Dr Vincent Marmara and Sagalytics during the second week of May 2020, and is supplemented by a resulting economic analysis carried out by The Office of Dr Joseph Muscat.

The findings show that during the period characterised by ongoing COVID-19 infections, even when opening up occurs, economic activity in Malta is expected to fall considerably as households seem to prefer to wait for the availability of a vaccine before returning to a normal level of activity. Still, even after the vaccine is made available to the general public, household consumption is currently expected to be lower than that prior to the pandemic. The latter indicates that the pandemic might have long lasting effects on economic activity, even amongst younger consumers. The uncertainty and prevailing state of mind of consumers, compounded by constant global messaging, is negatively affecting both the financial position of households and their propensity to spend.

The findings highlight the importance of devising correct economic incentives which on the one hand help increase household spending while at the same bolster consumer confidence when it comes to the safety of establishments. Boosting demand through incentives would not only dampen the economic downturn at the current juncture, but would also increase the confidence and financial positions of households, helping Malta to reach its pre-pandemic economic performance faster once a vaccine is made available.

It is also clear that incentivising the active participation of workers in the labour supply is a priority. The permanent effects on consumption behaviour seen in these results even after the discovery of a vaccine, together with a general tendency to avoid sending children to childcare facilities, might indicate that some households are considering to at least partially dropping out of the labour force. There are also indications of a gender imbalance when it comes to the effect of the pandemic, with women being probably hit disproportionally by the economic downturn.

The need to again boost labour participation rates is especially relevant when one considers that prolonged periods of inactivity would make it more difficult for workers, especially women, to reengage with the productive side of the economy.

Moreover, data shows that financial incentives aimed at increasing demand of activities that are considered as exposing people to greater risks of contagion, could help alleviate somehow the economic blow that is expected to hit these sectors. Still, this study shows that financial incentives need to be complemented with clear guidelines and mitigation measures that help reassure the general public of the safety of the establishments they wish to visit.

This Economic Note uses the survey results to attempt estimating the impact of the reduction in consumption on Gross Domestic Product, resulting in a contraction of -11% until a vaccine is found, and -2% afterwards, in line with our previous forecasts.

2. Methodology

The population sample of the survey is made up of 600 respondents which were randomly selected out of Malta’s population aged 16 and over. The survey is stratified across the age, gender and regional district dimensions, and can be considered to be representative of the general population, with a margin of error of +/- 4%.

The study seeks to capture changes in the consumer behaviour of Malta’s population across a spectrum of goods and services demanded following the onset of the COVID-19 pandemic. This survey also tries to elicit information on the effectiveness or otherwise of measures that can be taken by both private and public sector in order to attenuate the economic impact of the COVID-19. The questionnaire was jointly designed by Sagalytics and The Office of Dr Joseph Muscat.

3. Quantifying the Change in Consumption due to the Onset of COVID-19

In an effort to quantify the extent to which the COVID-19 situation has impacted consumer behaviour across different services, respondents were posed three questions:

“Until a vaccine is available (against COVID-19), if possible, for how many times will you go or use the following services?”

“When the vaccine is available, how many times are you going to visit or use the following places/services?”

These questions are asked with regards to the following services:

- Restaurants

- Coffee shops

- Clothes and footwear shops

- Other retail (furniture, home appliances)

- Break in a local hotel

- Break in a farmhouse in Malta / Gozo

- Holiday abroad

- Public transport

- Ride hailing services

- Taxis

This setup allows for a quantification of the effects that the COVID-19 pandemic is likely to have on household consumption before and after the availability of a vaccine. This in turn allows us to understand the extent to which households will cut back on their normal levels of consumption even as lockdown measures are lifted as they adjust to a period characterised by ongoing COVID-19 infections within the community. From these questions, we can also understand how important the availability of a vaccine is for household consumption to return to its pre-pandemic levels.

Table 1: Frequency of Uses across Categories

Monthly unless otherwise specified

3.1 A Fall and a Rebound in Consumption, but at Lower Levels

Results show that on average, consumption activity across the goods and services under consideration is expected to fall by around 81% during the period characterised by ongoing COVID-19 infections within the community.

Respondents have indicated that during this period when businesses start reopening, they are most likely to cut consumption of services and activities that are seen as posing the highest risk of contagion, that is activities that bring them in closer proximity to other people. These include holidays abroad (with average frequency falling by 93%) hotel breaks in Malta and Gozo (with a drop of 90%) and farmhouse breaks in Gozo (falling by 87%). Considerable decreases are also registered in the use of public transport and restaurants which are expected to fall by more than 80% even after the lifting of restriction measures. Retail activities, coffee shops and the use of ride hailing services are expected to be affected slightly less during this period.

Respondents have also indicated that once a vaccine becomes available to the general public, they intend to significantly boost the consumption of all activities. This indicates that the majority of households considers the eventual availability of a vaccine as necessary to return to their normal way of life.

Nevertheless, despite the significant pick-up in economic activity that is seen after the discovery of a vaccine, respondents have indicated that on average they still expect to consume less (by around 10%) than they did before the COVID-19 pandemic started. This indicates that at the current juncture, the pandemic is expected to have long-lasting effects on consumer behaviour.

This result must be read within the context of a general public that has been targeted, day in, day out, by what is arguably the largest ever, unplanned but coordinated, inter governmental and global media campaign in human history. The single message being played over and over again by practically every public official and media channel worldwide was on the need to stay inside and the daily dead tolls from around the world. Caution was necessary during a period of emergency. A sudden change in messaging is unlikely to happen, and even when it gradually happens, it is unlikely to immediately change the predominant mindset. Nevertheless, as the narrative slowly changes, one might see a more positive shift in outlook, and thus confidence and consumption, by consumers. As a result, these findings need to be read within this evolving context.

Taking the current expectations on consumption levels during a post-vaccine stage, permanent drops in consumer activity can be seen to persist in activities and services that are perceived to pose the largest risks of infection, that is in the consumption of holidays abroad, hotel breaks in both Malta and Gozo and public transport. If the latter materialises, gains in efficiency made through unprecedented investments in road infrastructure to alleviate traffic congestion might be redimensioned given a probable shift towards less collective means of transport.

The fact that the permanent drop in consumer activity extends to all activities and services considered in this survey, might also indicate that the current medical and economic uncertainty is negatively affecting consumers’ perception of their future financial position. In other words, even households that are not currently experiencing financial difficulties, are cutting back on expenditure because of fear of the unknown. In the light of this drop in consumer confidence, these responses might be indicative of an increase in precautionary savings during the pandemic, and even after a vaccine is made available. Preliminary banking data seems to confirm this trend.

When looking at a breakdown of results by respondent category, one finds that female respondents are more likely to cut the consumption of the activities and services under consideration than their male counterparts, both during the COVID-19 pandemic and even after the availability of a vaccine. Respondents across all age-cohorts expect to significantly cut their consumption activities during the period in which the pandemic is still ongoing, before increasing them again after a vaccine is made available, albeit at levels which are lower than the pre-pandemic period.

3.2 The Reluctant Youth

It is striking that despite the scientifically proven lower level of susceptibility of the younger cohorts to COVID-19 complications, respondents aged 16-25 are expected to cut consumption activities across all sectors by around 80%. Moreover, in some cases such as restaurants, holidays abroad and hotel and farmhouse breaks, respondents in the youngest cohort are expected to cut consumption by a larger extent than the 66+ cohort, that is the sector of the population which is most susceptible to COVID-19 related complications.

This point has very important implications especially when it comes to forecasting the economic effectiveness of the relaxation policies currently under way. Indeed, these figures might suggest that contrary to a-priori expectations, the younger cohorts are not expected to boost their consumption pattern significantly after relaxation measures. The exception to this is consumption in restaurants and other retail, where the activity levels for this age group is expected to surpass pre-pandemic levels.

There are a number of factors which can explain what is probably a surprising result, with some of them being the significant exposure of young people to social media which was dominated by pandemic related material, and the relative ease with which this cohort can switch its mode of social interaction remotely, be it for work and entertainment purposes. While this analysis falls outside the scope of this Economic Note, it is probably a finding that merits more research, especially from a sociological perspective.

3.3 COVID-19 Wage Supplement: Necessary in the Short Term, to be Tapered in Medium Term

These results can also be broken-down by whether respondents are either currently in employment and receiving their full wage, in employment and receiving the COVID-19 wage supplement or whether they are not currently employed. This breakdown shows that the COVID-19 wage supplement is quite effective in temporarily sustaining expenditure at the current juncture. Indeed, during the current pandemic, respondents on COVID-19 wage subsidies expect to frequent the establishments considered in this exercise only marginally less than their counterparts who are employed but not receiving a subsidy.

This result however should not be interpreted as suggesting that economic recovery could take place through such subsidies. This tool is effective at alleviating the negative income effects at a time of crisis, but is surely not enough to sustain the normal level of household consumption. This belief is reinforced by the fact that all types of respondents are expected to cut their consumption pattern significantly even after the vaccine for COVID-19 is made available, suggesting that consumers are concerned about a possible loss in their permanent income.

Faced with this situation, policymakers can either increase the subsidies or taper them off to help put people back in employment. The first option might be popular and attractive in the short term, but is surely unsustainable. It would probably lead not only to a collapse in public finances, but also to a decrease in productivity and competitiveness, thus leading to spiralling unemployment. Furthermore, it would lead to social tensions between those on such subsidies, those economically engaged, and those on a contributory pension who would all feel shortchanged.

To avert an outcome where economic agents become discouraged and alienated and thus drop out of the labour force, policy needs to encourage workers to engage back to the productive side of the economy as soon as it is safe to do so. Tapering of benefits, as already successfully implemented in Malta over the past years, and incentives to businesses, might be less popular and attractive, but are probably more effective tools.

3.4 Use of Childcare Facilities

The re-engagement in the labour force, especially of women who are evidence of the success of Active Labour Market Policies over the past few years, is particularly relevant in the light of information collected in this same survey about the use of childcare centres.

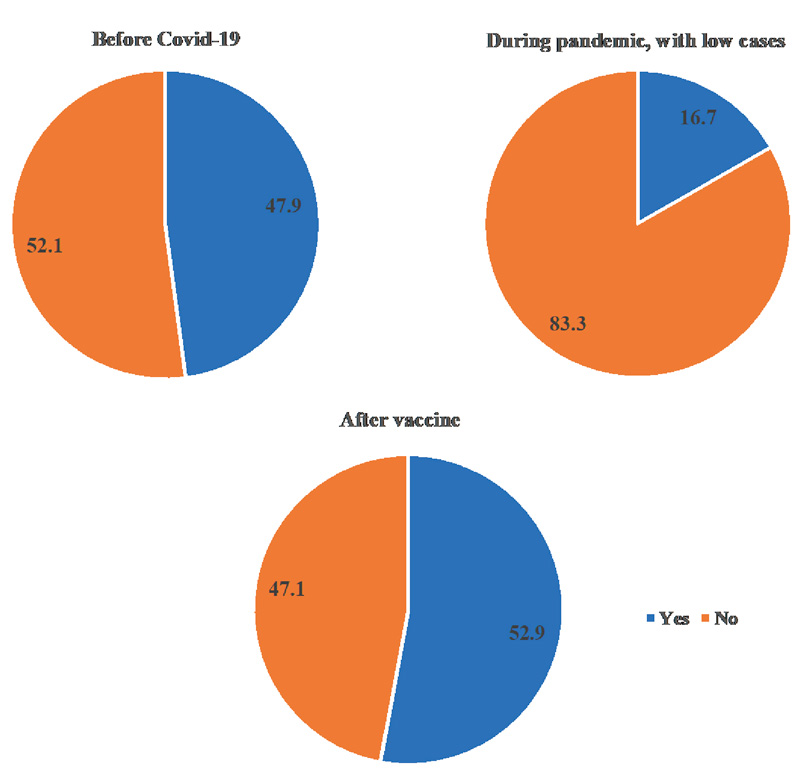

Around one in ten respondents have indicated that they have a child who is less than five years old. Out of these, around half stated that they used to send their children to childcare centres before the pandemic started. When asked whether they would send their children to childcare centres before a vaccine is found but with low daily cases of COVID-19, only 17% answered positively. This number goes up to around 53% once a vaccine is found and made available.

The general reluctance to send children to childcare facilities before a vaccine is found could indicate that at least one of the two parents (where there are two parents) in a household would be required to stay at home for childcare purposes. This has major economic and social repercussions as it implies that there is a concrete risk of workers deciding to drop out of the labour force for the duration of the pandemic, impinging negatively on the supply side of the economy. It is probably safe to assume that women, especially those from a deprived background, will be those to suffer most, and will risk to lose the financial independence they gained over the past years.

This effect also risks to prolong itself even after the pandemic eases, as it becomes increasingly difficult for workers who have been out of the labour force for a long period to re-engage with the productive side of the economy. Once again, women are those most at risk of also falling back in the poverty trap. This gender perspective to the COVID-19 pandemic also merits further research.

Chart 1: Percentage of Respondents with a Child less than 5 Years of Age who makes use of Childcare Facilities

4. Financial Incentives to Kickstart the Maltese Economy

In order to understand which service activities are most likely to be assisted by financial incentives aimed at boosting consumer demand, respondents have been asked the following questions:

“If the government provides a financial aid in order to go for a break in a Gozo before a vaccine against COVID-19 is available, would you consider going?”

“If the government provides a financial aid in order to do some maintenance or change appliances in your household before a vaccine against COVID-19 is available, would you consider to go and buy?”

Tables 2 and 3 below look at the marginal effectiveness of these measures, by comparing the frequency of use of these three activities before the pandemic with the activity projected whilst the pandemic is still under way, with and without financial incentives.

Table 2: Frequency of Uses across Categories

Monthly unless otherwise specified

One can note that financial incentives are an effective tool in stimulating demand. In the case of internal tourism, they can increase demand three fold when compared to a non- intervention scenario. Nevertheless, the level of activity would still be less than half of the pre-pandemic stage.

When looking at the proportion of respondents that would consider making use of these activities if financial incentives are offered, around 35% of respondents would consider to go for a local holiday. This number is significantly lower than the proportion for Other Retail which stands at around 65%. In fact, is definitely much scope for incentives in the upgrade and maintenance of households, where consumers seem to be more receptive to such stimulus.

One needs to point out that a further 30% of those who said they would not go for a local holiday, would then change their decision if given a financial incentive. The same relative magnitude is maintained on other retail where 60% of respondents who maintained they would not engage in such activities until a vaccine is available, then change their opinion given a financial incentive.

Looking at a geographical breakdown of the latter results one notes that respondents residing in the Northern district are the less likely to answer yes to these questions even if they receive financial aids. On the other hand, residents of the Western region are the most likely to go on a local holiday.

The low proportion of respondents that are likely to make use of services that are considered to pose a relatively higher risk of contagion, even after financial incentives are in place, implies that a proportion of consumers are not convinced of the safety of the establishments offering these services, and need to be reassured about them. The wider implication is that if it is a challenge for local establishments to claim the confidence of local consumers who are already familiar with them, it will be more of an uphill struggle with foreign consumers visiting as tourists.

Table 3: Percentage of Respondents using a Service with Financial Incentives

This has to be seen as a main policy challenge where initiatives must not only be aimed at boosting consumer confidence, both from an economic and safety perspective, but also at gearing businesses to adapt to transparent sanitary standard operating procedures. These procedures cannot be considered as overheads but rather as a necessary investment to maintain the confidence even of regular clients, let alone attracting new ones.

This in turn implies that the relaxation of COVID-19 measures needs to be complemented by both financial aid and clear guidelines that help reassure the general public of the safety of the establishments they wish to visit.

5. Mitigation Measures and Guidelines to Boost a Consumer Confidence

In order to understand which measures and guidelines could bolster confidence in the safety of certain establishments, we have asked the following question:

Use of hand sanitisers and facial masks as well as regular cleaning are the three mitigation methods that are by far preferred by Maltese consumers. The availability of hand sanitisers was chosen by 93% of respondents as helping them feel comfortable in the establishments under consideration, followed by 89% for regular cleaning and 84% for the use of face masks.

From a more holistic approach, consumers see value in a certification mechanism by competent authorities, which would help assure them that the establishment they are visiting is following pre-established sanitary protocols. The mitigation measures which are the least effective in boostin consumer confidence, but still enjoy the support of a majority of respondents, are online cameras in shops to watch cleaning procedures and crowding, and cameras in restaurant kitchens.

The data shows that there are interesting variations across both cohort and regional dimensions. For instance, while 75% of respondents aged 16-25 feel that contactless payment methods are useful in reducing contagion risks, this number falls to almost 50% when considering the oldest cohort aged 66+.

On the other hand, certification of establishments seems to be more popular with the older two cohorts. Moreover, respondents residing in the Southern and Northern harbour districts seem to be relatively more sceptical of all mitigation measures when compared to the rest of the respondents.

Table 4: Mitigation Measures that make Consumers feel Safer

6. Aggregate Consumption is Expected to Fall Significantly before Rebounding Somewhat

In order to understand what these survey results imply on Gross Domestic Product aggregates, we have undertaken a grossing up exercise.

The services and activities included in the survey have been mapped to the final consumption expenditure of households disaggregated by Classification of Individual Consumption by Purpose (COICOP at 3 digit level as at 2019). We have then used the weights corresponding to each COICOP sub-category to gross-up the figures that have emerged from this survey.

This mapping exercise, indicates that the services and activities considered in this survey cover around 43%, that is a considerable proportion, of all activities that fall under household consumption. Moreover, the proportion of aggregate household consumption that is not captured by this survey includes consumption activities that are less discretionary in nature than those included. These include consumption on food and beverages, water and electricity consumption, health, education and communication.

In order to come up with a conservative estimate of the change in aggregate consumption, we assume that these consumption sub-categories remain constant at their baseline level, that is, that they are not affected by the pandemic.

Table 5: Expected Effects on Aggregate Consumption and GDP

Results shown in Table 5 indicate that in the period characterised by ongoing COVID-19 contagion within the community, aggregate consumption is expected to fall by around 34%. Aggregate consumption is then expected to rebound after the discovery of a vaccine, albeit remaining lower than the pre-pandemic levels by around 6%.

Under the assumption that there are no changes to the other aggregate demand components, and taking in consideration the import intensity of household consumption, these figures are expected to translate to a contribution to aggregate GDP of around -11% before a vaccine is found and -2% when a vaccine is found.

These findings point to the same trajectory of the Gross Domestic Product forecasts in our first Economic Note² and which makes us fairly optimistic that although a bumpy road lies ahead, the Maltese economy can be one of the first to rebound to pre-pandemic levels amongst its peers.