Economic Note: The Economic impact of COVID-19 during and after the emergency

Compiled by The Office of Dr. Joseph Muscat and Sagalytics¹

1. Executive Summary

This Economic Note summarises the main findings of a telephone-based, scientific survey conducted by Dr Vincent Marmara and Sagalytics during September 2020 and is supplemented by an economic analysis carried out by The Office of Dr Joseph Muscat. It therefore updates the assessment that was carried out in September 2020.

The findings of this latest survey suggest that the Maltese population is sceptical of a swift return to pre-COVID-19 normality even after the successful vaccine programme, despite the youngest cohort consistently showing the largest levels of optimism. This is mostly clear in the reluctance shown by the majority of the population in going abroad for a holiday this summer, indicating that a sizeable part of the Maltese population considers that a complete return to normality will be particularly slow. Despite this scepticism, the vast majority of respondents believe that the wearing of masks should not remain obligatory after vaccination.

Results also show that even after vaccination, some developments that have occurred during the height of the pandemic are here to stay. The most prominent is the shift to online shopping with respondents indicating the intention to keep using this method for all services considered in this study. This is especially the case for daily groceries and take away food where the predicted use of online shopping post-pandemic is projected to exceed that prior to the COVID-19 emergency. Unsurprisingly, the youngest cohort seems to be the most prone to choose online shopping for a relatively large share of their consumption.

This study has uncovered that the fast roll-out of the vaccination programme has contributed significantly in boosting consumer confidence and also consumption levels. This is shown by the fact that actual consumption of services, especially restaurants, has climbed considerably from the levels seen in summer of last year.

Projected consumption levels after vaccination show a very stark distinction in consumption levels relative to their pre-COVID-19 levels. Consumption of services such as restaurants and coffee shops is set to return to levels which are very close to, albeit still lower than, pre- pandemic levels. On the other hand, significantly less robust improvements are predicted for the travel industry and the use of public transport. Moreover, when these figures are compared with previous forecasts of post-COVID-19 consumption levels, we only see marginal improvements relative to our projections of May and September 2020. Thus, while the vaccine roll-out has certainly improved consumer confidence and boosted consumption at the current juncture, the extent of the upward revisions in post-COVID-19 forecasts is low particularly for hotel breaks, holidays abroad and the use of public transportation.

Finally, survey results suggest that the renewed Government Voucher Programme is set to be successful at boosting consumption in the short run, with a third of respondents forecasting an increase in consumption due to the availability of vouchers. This proportion is slightly higher than the increase in consumption attributed to the first voucher programme by previous studies, implying that the voucher scheme is still a powerful short-run economic stimulus.

Of relevance is also the fact that a majority of more than two to one believe that Government should discontinue providing the wage supplement once that almost all of the population is vaccinated. The favoured economic regeneration policy is facilitating growth, while increased taxation, even of the higher income brackets, is not viewed positively.

These results have two important policy implications. First, they point to an important element of long-run scarring left by the pandemic, which is best displayed in the long-run drops in consumption levels across all population categories, and that are predicted to persist even after the current vaccination programme is complete. While the policies enacted up till now by Government were quite successful in propping up consumption in the short-run, new policies are required that are aimed at effectively tackling the underlying issues which are at the heart of the long-run drops in economic activity being predicted.

Secondly, results have persistently pointed to a general reluctance of the local population to use public transport during the crisis, a phenomenon which is also expected to persist after the vaccination programme. If this materialises, and is not accompanied by an increase in home-working solutions, it would probably have serious ramifications on Malta’s traffic management and the ability to reach its climate change objectives in terms of its economy’s carbon footprint. Alternatively, more incentives to use public transport, including the option to make it free of charge for residents, should be actively pursued.

2. Methodology

The methodology is consistent with the surveys undertaken back in May and September of 2020. The sample of the survey is made up of 600 respondents which were randomly selected out of Malta’s population aged 16 and over. The survey is stratified across the age, gender, and regional district dimensions, and can be considered to be representative of the general population, with a margin of error of +/- 4.

The questionnaire was jointly designed by Sagalytics and The Office of Dr Joseph Muscat. The survey seeks to capture changes in the consumer behaviour of Malta’s population across a spectrum of goods and services demanded following the onset of the COVID-19 pandemic. This survey also tries to elicit information on the effectiveness or otherwise of measures that have been undertaken by the public sector in order to attenuate the economic impact of COVID- 19, and whether further measures might be needed in the near future.

A set of survey questions are designed in line with those featuring in previous surveys undertaken in May and October 2020. We therefore ask respondents four questions:

“How many times did you go to or used the following services during the vaccination period?”

“How many times will you use the following services after you have been vaccinated?”

These questions are asked with regards to the following services:

- Coffee shops

- Clothes and footwear shops

- Other retail (furniture, home appliances)

- Break in a local hotel

- Break in a farmhouse in Malta / Gozo

- Holiday abroad

- Public transport

First and foremost, the design of the survey allows us to compare the projections of household consumption by sector as reported by respondents in the first and second surveys, with actual realised consumption behaviour as reported in the latest survey. This comparison is important in understanding whether Maltese households have started to reassess their projected consumption profile when compared to that planned back in and in September 2020. Similar to past surveys we also ask the population on the extent of the effectiveness or otherwise of government financial aid.

The survey tries to elicit new information regarding the return to normality. In particular, we ask respondents how they expect to change their consumption behaviour after the majority of the population is vaccinated. This question is important as it follows similar questions asked back in May and September of 2020, allowing us to understand whether the population has adjusted their projected consumption patterns as originally expected before vaccination. Furthermore, it allows us to understand whether some sectors are likely to be affected by a degree of permanent scarring even after the COVID-19 emergency is controlled through vaccination.

Apart from comparing with recent surveys, the new study encompasses new questions designed to shed light on the population’s understanding of the “new normal” after the whole population is vaccinated against COVID-19. We ask questions relating to the removal of face masks after vaccination and on whether the Government should continue to help businesses and workers in need even after the vaccination programme is completed. These questions allow us to understand the Maltese population’s beliefs on whether vaccinating the whole population is enough to completely control the pandemic and thus return to their pre-pandemic way of life.

3. The return to normality

In line with official statistics, survey data has shown that around 80% of the respondents are fully vaccinated against COVID-19. Apart from underlining the efforts by the health authorities to ramp up the vaccination rate in Malta, these statistics show that the vast majority of the Maltese population is willing to get vaccinated. However, despite the high vaccination rates and exceptionally high efficacy, less than half of the respondents believe that their life will return to a pre-COVID-19 normal.

Around 22% of respondents are still unable to determine whether normality will ever be achieved even after vaccination. This figure is considerably low when compared to results of international studies. A survey compiled by the international research and consultancy firm Ipsos shows that around 60% of the world population believe that life will return to normal in the next 6 months or so, thus immediately after the vaccination process has ended, with a further 30% believing that even after vaccination it will take more than a year for life to return to a pre-COVID-19 normal.² Only 8% of the world population believe that their life will never return to its pre-pandemic normal.

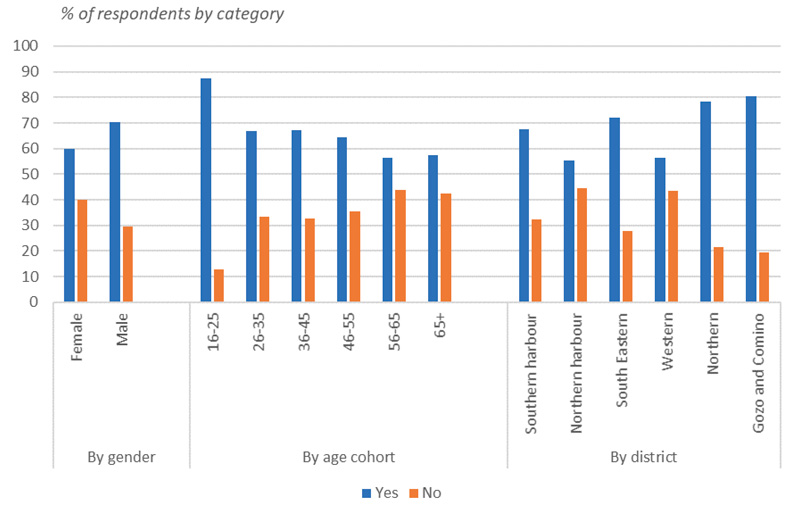

Results for Malta are robust across both genders and exhibit considerable age and geographical heterogeneity. Chart 1 shows that the youngest cohort under consideration is by far the most optimistic with around 70% believing that after vaccination, life will return to the pre-COVID- 19 normal. The least optimistic are respondents within the 36-45 cohort where 4 in 10 believe that life will not return to normal after vaccination.

Looking at heterogeneity by district, respondents residing in the Southern Harbour region are the most optimistic, with 64.5% believing that life will return to normal after the vaccination stage is completed. On the other hand, only 40% of Northern Harbour residents share the same belief. However, the latter figure is characterised by a considerable degree of volatility with more than a third of respondents declaring to be uncertain about this outcome.

Chart 1: Return to Normality

The belief of a slow return to normality and the considerable sense of uncertainty are also displayed in the small proportion of respondents that are willing to travel abroad this summer. 63% of respondents have reported that they are not willing to go on a holiday abroad this summer with only 21% answering that they have planned such a holiday for this year. Results show no particular heterogeneity across gender and limited heterogeneity across age and district.

As expected, the youngest cohort is the most likely to go abroad this summer while the eldest are the most reluctant. Still, only around 30% of the youngest respondents have confirmed their intention to visit another country during this summer, a figure which contrasts with the proportion of respondents in the same cohort who believe that life will return to normal after vaccination. Similarly, while respondents residing in the Southern Harbour region were the most optimistic when it comes to a return to normality, they are the least likely to be travelling abroad this summer.

These figures show that even in the most optimistic cohorts when it comes to the return to a normal way of living, especially when it comes to travelling abroad, will be expected to be particularly slow.

Chart 2: Travelling abroad

The belief of a slow and uncertain return to normality contrasts with the number of respondents claiming that they will continue wearing masks even after vaccination. Results shows that almost two thirds of the population believe that after vaccination we should not be wearing a mask. Contrary to the question related to the return to normality, results for the wearing of masks depend significantly on gender, with males being predominantly more in favour of removing face masks than females.

Considerable heterogeneity is also found when results are decomposed by district of residency and age. The youngest cohort considered in this exercise is consistently the most optimistic about the future, with almost 90% of respondents aged between 16-25 believing that we should not wear masks after vaccination. The proportion of respondents believing that the wearing of masks should not continue after vaccination falls considerably with the oldest population cohorts, reaching a minimum of 58% for the population aged 65+. Looking at results by district, the percentage of respondents that believe that mask wearing should not continue after vaccination ranges from around 56% in the Northern Harbour and Western regions to almost 80% in the Northern region including Gozo.

Chart 3: Remove face masks

Another interesting insight can be gleaned from responses related to questions on the use of childcare services. More than half of the parents who were interviewed used to send their children to childcare before the pandemic. Almost 65% have now restarted to use this service again, with considerable regional heterogeneity. The proportion of parents living in the Western region not sending their children to childcare is about double that of parents living in the South East of Malta. Of those parents who are yet not sending their children about 86% stated that they would be using the service again once they (the parents) were vaccinated. Even if one accepts this result, which is strange given that most parents are vaccinated, that would still imply that about one in ten of parents who used to send their children to childcare do not think they will be using this service after being vaccinated.

Another interesting factor that emerges from the survey is that only about half of respondents were aware that children using childcare services cannot be vaccinated yet. This could potentially have even further impact on the use of these services.

4. Online shopping here to stay

During the pandemic, the global retail and food services sectors have had to adapt promptly to a range of Government measures which have, at the best of times, forced most establishments to operate at reduced capacity. At the height of the pandemic, these establishments were also forced for a number of times to close their doors to customers.

Even when restrictions and mitigation measures were slowly lifted, food services and retail establishments were still severely affected by a level of insecurity as most customers felt unsafe when either purchasing or eating indoors. Shop owners have had to adapt quickly and diversify their retail model away from in-person purchases. This was facilitated by the significant and recent technological advances which allowed both retail and food services establishments to quickly shift their operations online.

Table 1: Online Shopping

Table 1 shows that during the pandemic there was a considerable increase in the use of online shopping for everyday groceries, clothes and footwear and take-away food. There is a clear willingness to keep using online shopping even after the population is vaccinated. This is especially the case for daily groceries and take away food where the predicted use of online shopping post-pandemic is projected to exceed that existing prior to the COVID-19 emergency. As for clothes and footwear and other non-food purchases, one needs to consider that even before the pandemic most Maltese (75%) had been purchasing online.³

Respondents in the two youngest cohorts (16-25 and 26-35) and those residing in the Northern, Northern Harbour and South Eastern regions have showed a larger willingness to continue using online shopping solutions when compared to the rest of the population.

5. Vaccine roll-out boosts consumption

Our previous surveys have shown that the COVID-19 emergency have led to considerable reductions in the consumption of several services, ranging from restaurant and food services activities to the use of public transport. The last survey conducted in September 2020, had uncovered consumptions levels that were considerably better than what was anticipated back in May of the same year as households started reassessing the risks associated with the pandemic and started to come to terms with the new normality characterised by an ongoing COVID-19 transmission within the community. Still consumption levels were significantly lower than pre-pandemic baseline levels due to the persistent element of risk associated with most social interactions.

The start of a global vaccination programme is a crucial development that took place since the last survey was conducted in September of 2020. The concrete prospect of reducing risks associated with social interactions should have increased consumer confidence and boosted consumption levels. In order to capture any improvements or otherwise in consumption levels that are attributable to the vaccine roll-out, we compare the actual frequency of consumption that took place in the vaccination period with the actual levels of consumption reached during summer of 2020. Data shows that consumption of all services during the vaccination programme rollout have improved drastically when compared to summer 2020 levels.

When compared to pre-pandemic levels, consumption of restaurant services has climbed from a negative 40% to a negative 20%. Even stronger gains can be seen in the retail sector and in farmhouse breaks and holidays aboard.

Despite the improvements seen in the latter, the average frequency of holidays abroad is still half that witnessed prior to the onset of the COVID-19 pandemic, mirroring results discussed in the previous section. These results show that the fast roll-out of the vaccination programme has contributed significantly in boosting consumer confidence and consumption levels.

Chart 4: Change in consumption duing vaccination period

Chart 5 shows the consumption revisions in percentage points between summer 2020 and current levels during the vaccination process decomposed by gender, age and district. Results indicate that female respondents have had the strongest average revisions across all categories. Above average upward revisions in consumption levels were also witnessed in the 36-45 age category and in the oldest two cohorts. Looking at the data decomposed by district of residence, we note that respondents residing in the Northern Harbour area have increased consumption the most when compared to summer 2020.

Chart 5: Revisions in consumption by category

6. Improved economic outlook but still below pre-COVID-19 levels

In line with the two previous Economic Notes produced in 2020, respondents have indicated that once they are vaccinated against COVID-19, they intend to significantly boost the consumption of all activities. The strongest revisions are projected to occur in consumption of restaurants and coffee shops services, where consumption levels after vaccination are expected to return very close to pre-pandemic levels. Significant improvements in consumption are also envisaged in the retail sector and in internal tourism.

After vaccination, expenditure in clothes, footwear, and other retail establishments as well as hotel and farmhouse breaks are expected to reach around 85%-90% of the pre-COVID-19 levels. Less robust improvements are seen in services that require transportation. Mirroring previously discussed results, even after vaccination, the frequency of going on holidays abroad is expected to remain less than 70% of the pre-COVID-19 levels. Similar results are seen in the use of public transportation which almost does not record any improvements due to vaccination.

The latter result has important ramifications, especially with regards to the national traffic management and on managing Malta’s carbon footprint. If the drop in the use of public transportation is accompanied by a rise in the use of private transportation, one can easily project a worsening of traffic congestion and air pollution issues especially if all employees start to work from office as COVID-19 mitigation measures are slowly lifted. Alternatively, more incentives to use public transport, including the option to make it free of charge for residents, should be actively pursued.

All in all, despite the significant pick-up in economic activity that is seen after the vaccination of the whole population, respondents have indicated that on average they still expect to consume less than they did before the COVID-19 pandemic started.

Chart 6: Improvements in Consumption due to vaccination

Chart 7: Post-Covid consumption forecasts across time

From our previous analysis, we are also able to estimate the extent to which respondents have updated their projections for their post-pandemic consumption levels. Chart 7 shows the permanent drops in consumption projected by respondents across three surveys. Data shows that between May 2020 and September 2020, respondents have projected more significant long-term cuts in the consumption in almost all sectors under consideration. These results should however be interpreted within the context of considerable uncertainties with regards to the timing and efficacy of an eventual vaccine.

The latest set of results should internalise the reduction in uncertainty about both timing and efficacy of the vaccine, since they are consistent with responses from a survey conducted in June of this year. In fact, the latest results show a considerable reduction in the projected consumption cuts of a number of services, namely restaurants and coffee shops. Still, the extent of these revisions, especially to hotel breaks and holidays abroad, are lower than expected considering the efficacy of the current vaccines and the speed of the vaccine roll-out.

The cuts in long run consumption might be reflecting the recently increasing uncertainty brought about by the rise of new COVID-19 variants that could curb the worldwide efforts to reduce mitigation measures as well as renewed concerns about the health of the global economy as it emerges from the emergency.

Table 2: Expected effects on aggregate consumption and GDP after vaccination

In order to understand what these survey results imply on Gross Domestic Product aggregates, we have undertaken a grossing up exercise, similar to the ones undertaken in May and September of last year. The services and activities included in the survey have been mapped to the final consumption expenditure of households disaggregated by Classification of Individual Consumption by Purpose (COICOP at 3-digit level as at 2019). We have then used the weights corresponding to each COICOP sub-category to gross-up the figures that have emerged from this survey.

This mapping exercise indicates that the services and activities considered in this survey cover around 43%, that is a considerable proportion, of all activities that fall under household consumption. Moreover, the proportion of aggregate household consumption that is not captured by this survey includes consumption activities that are less discretionary in nature than those included. These include consumption on food and beverages, water and electricity consumption, health, education, and communication. In order to come up with a conservative estimate of the change in aggregate consumption, we assume that these consumption sub- categories remain constant at their baseline level, that is, that they are not affected by the pandemic.

In line with the above analysis, consumption levels after the end of the two shot vaccination programme have been revised upward when compared to the previous surveys, especially when compared to the September survey. This is to be expected given the fact that the June survey is the first one that encompasses the concrete availability of a vaccine. Still aggregate consumption after the vaccination roll-out is complete is 5.3% lower than the level achieved prior to the COVID-19 emergency, leading to a drop in overall aggregate economic activity of slightly less than 1.8%.

7. Positive effect of Government vouchers

The positive effect of Government vouchers to boost consumption is confirmed. 36% of respondents claimed that the new voucher programme launched by Government is likely to boost their consumption, while 62% answered that it will leave their consumption levels unaltered. This figure is in line with the proportion of respondents who back in September 2020 have claimed that a new voucher programme in the future would help them increase their consumption. Also, the proportion of respondents who claim that the voucher scheme will likely increase their consumption profile is higher than that claimed for the past voucher scheme, implying that the voucher program is still a very powerful economic stimulus.

Looking at a demographic disaggregation of results, the voucher scheme is expected to be mostly effective in propping up consumption of females and of respondents in the 16-25 age cohort. Respondents living in the Southern Harbour region are the most receptive of vouchers, with more than half claiming that the new scheme will likely increase their consumption levels.

On the other hand, those residing in the western part of the island are the least likely to increase consumption due to the new voucher scheme. These results are in line with the results that featured in the survey conducted in September, where the youngest respondents and those residing in the southern harbour area had indicated that a new voucher programme would likely boost their consumption. In the same survey, respondents residing in the Western part of the island where indeed the most sceptical of the effectiveness of further vouchers.

Chart 8: Effect of new voucher scheme

8. Vast majority believe wage supplement should be discontinued

Of the over three-quarters of respondents with a stated opinion on the matter, a majority of more than two to one believe that Government should discontinue providing the wage supplement once that almost all of the population is vaccinated. The strongest opinions in this regard are held by those close to retirement age, where the majority is closer to three to one. By contrast younger respondents are more open to the idea that financial aid should continue. On a regional level, respondents in Gozo are more in favour of the wage supplement being retained, with support for aid continuing nearly equal to those against.

When asked what Government should do to recover the millions of euro spent in supporting the economy, about a quarter favoured a return to pre-COVID-19 economic policy, that is boosting economic growth. Appetite for increased taxation is low, even if directed towards high income earners, with just 9% in favour and 6% against. Imposing expenditure cuts is also not seen as an option by most respondents while just under 4% saw European Union funds as a way to recover financial sustainability. About a quarter of respondents either did not express an opinion on what measures Government should undertake, or else stated that nothing needed to be done.

9. Conclusion

The study has outlined two important trends in consumer sentiment. On one hand, the start of the vaccination programme has led to an increase in the consumption of all services under consideration. On the other hand, the expectation of a complete return to normality is dampening, with a significant proportion of the population who are either unsure of whether we will ever return to a normal way of living or are outright certain that they will never fully regain their previous life.

This points to an important element of long-run scarring from the pandemic, which is best displayed in the long-run drops in consumption levels across all population categories that are predicted to persist even after the current vaccination program is complete. These drops in consumption can be found at varying degrees across all sectors considered but are mostly evident in services such as holidays abroad, farmhouse and hotel breaks, and use of public transport. This drop in post-vaccine consumption has been a consistent prediction of all surveys conducted up till now lending credibility to the thesis that the pandemic could lead to permanent effects on the economy in the absence of policy measures.

This has two important policy implications. First, as shown by this study, government vouchers are especially successful in boosting consumption in Malta by temporarily increasing liquidity of households and more importantly by boosting consumer confidence in the safety of the establishments that were most hit by the crisis. However, such policies are by their very design temporary in nature as they are specifically designed to address drops in consumption only in the short-run. On the other hand, the long-run falls in consumptions predicted in all surveys conducted up till now point to underlying issues which are of a more long-run nature. These issues might stem from either medical or economic uncertainty. The repeated observations of new COVID-19 variants together with the uncertainty surrounding the efficacy of vaccines in preventing infections in the long-run might be weighing down on respondents’ expectations about the future. Economic agents might be internalising their expectations that the pandemic shock might have some long-run economic repercussions which would then lead to a weaker financial position than that enjoyed prior to the crisis.

A majority of more than two to one believe that Government should discontinue providing the wage supplement once that almost all of the population is vaccinated. The favoured economic regeneration policy is facilitating growth, while increased taxation, even of the higher income brackets, is not viewed positively.

Against this backdrop, one needs to identify and better study the underlying issues behind the drops in long-run consumption and formulate adequate policy responses which might be different depending on whether the causes are of a behavioural, medical, or financial nature.

Secondly, the unwillingness of the Maltese public to use public transport has been evident across the three surveys conducted up till now. Throughout the length of the pandemic, respondents have repeatedly shied away from using public transport. Moreover, results indicate that even after the vaccination program is completed, the frequency of use of public transport is expected to remain almost 30% less than pre-COVID-19 levels. This has important implications on the traffic management and for Malta’s ambition to hit its climate change targets.

If the long-run drop in public transport use materialises, gains in efficiency made through unprecedented investments in road infrastructure to alleviate traffic congestion might be re- dimensioned given a probable shift towards less collective means of transport. Moreover, the increased use of public transportation is usually a very effective way to reduce carbon emissions derived from transportation as these are typically much more efficient ways of transportation than non-collective means.

A drop in the permanent use of public transport, especially if not accompanied by a shift towards a more wide-spread use of home working solutions that might somehow reduce demand for transportation, would have serious implications on the carbon footprint of the Maltese economy. Alternatively, more incentives to use public transport, including the option to make it free of charge for residents, should be actively pursued.